Microsoft's Xbox is Thinking Outside the Box

Towards a $32 Billion Gaming Empire

Consoles & Exclusives

Publisher

Mobile & Cloud

Content & Services

Playing the Long Game

In a world driven by software, hardware was a leap Microsoft hesitated to take.

“If you want to be a great software company, you have to be ONLY a software company. You can’t dabble in other things.”

Bill Gates

But a spark of ambition ignited the green light, and from there, Xbox was born. Ever since then, it’s been a whirlwind.

From console wars to inconsistent messaging…

July 2020: Satya Nadella says "this year was simply a breakthrough quarter for gaming,” adding that Game Pass is seeing "record subscriber growth" on console and PC. The sub number was 10M back then.

July 2020: Xbox's marketing boss Aaron Grenberg said Game Pass was "not a big profit play" for MSFT as its just starting the program. "It's an investment which will ultimately pay dividends down the road."

Nov 2020: The Xbox Series X launches.

May 2021: Xbox Vice President Lori Wright says "All Xbox hardware has been sold at a loss, not one single sale has been profitable," justifying the 30% comission to developers is required to even build the console.

Jan 2022: MSFT announces intent to acquire Activision Blizzard King - concluded Oct 13, 2023.

Nov 2022: Xbox loses as much as $200 on every Xbox, says Phil (during the WSJ Tech live event).

Oct 2022: Around the same time, Phil says Xbox Game Pass is profitable, making up 15% of MSFTs revenue.

Dec 2022: New Xbox games will cost $70, joining the rest of the games industry. Microsoft has entered in a decade-long commitment to bring Call of Duty to Nintendo and Steam, to counter Sony's anti-merger arguments against the Activision Blizzard deal.

Feb 2022: Xbox Game Pass could come to Steam, says Valve’s Gabe Newell.

Dec 2023: Xbox confirms once again that “content and services is our north star,” (following its loss in the gen8 console race.)

They are building the plane while flying it, all the way to Xbox exclusives eventually landing on rival turf.

Xbox is obviously chasing a vision beyond just console wars. It's on a quest to uniting a divided community under the banner of Xbox Everywhere. A journey towards a $32 billion gaming empire.

Crossroads & Revolutions

To truly understand Xbox’s plan, let’s first look at another game changer: Nintendo.

It was the early 2000s, and Nintendo faced a stark reality. After losing to Playstation again, the house of Mario was in trouble. The GameCube had fallen behind, and Nintendo needed a new direction. And that direction had a name: Revolution.

Revolution was the codename for the Wii. Along side DS and Switch, the Wii was a huge success. By dropping the battle with Xbox and Playstation, Nintendo launched three systems, each surpassing 100 million sales.

Nintendo DS - 154M

Nintendo Switch - 130M

Nintendo Wii - 100M

Nintendo showed that their Project Revolution strategy was not just about survival - but a masterclass in adaptation.

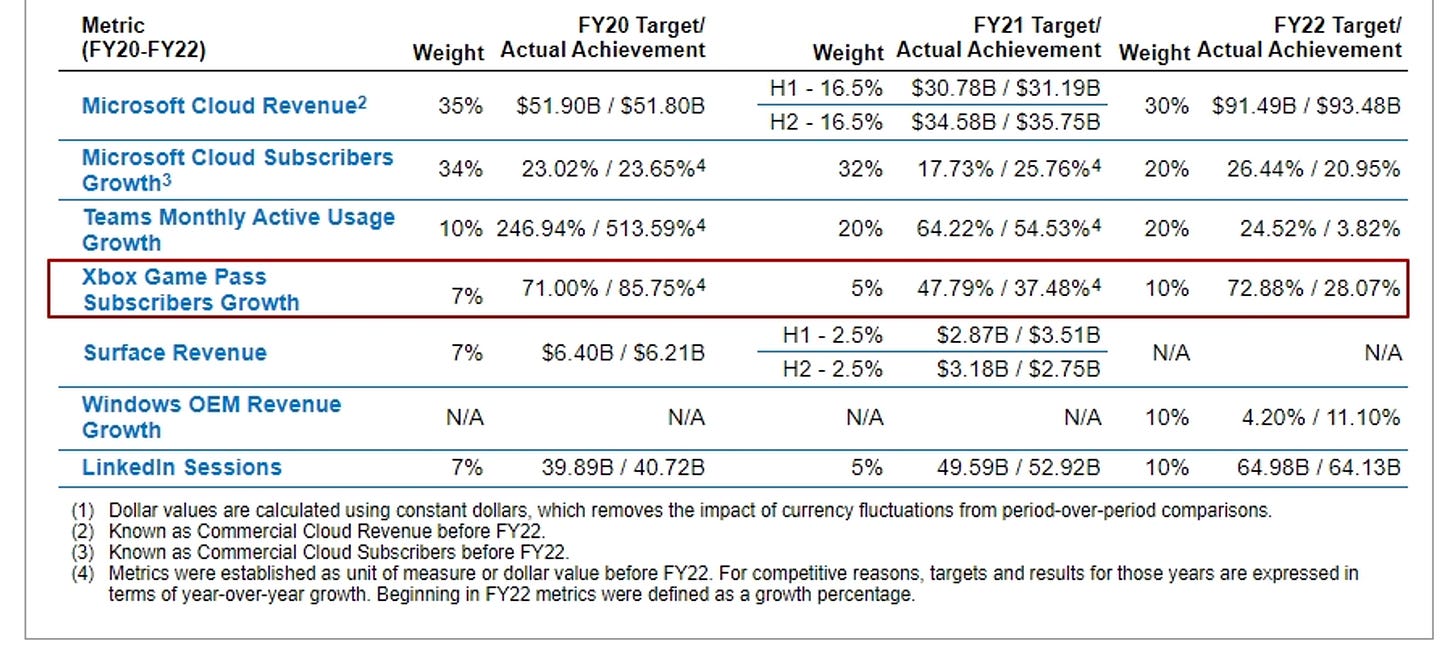

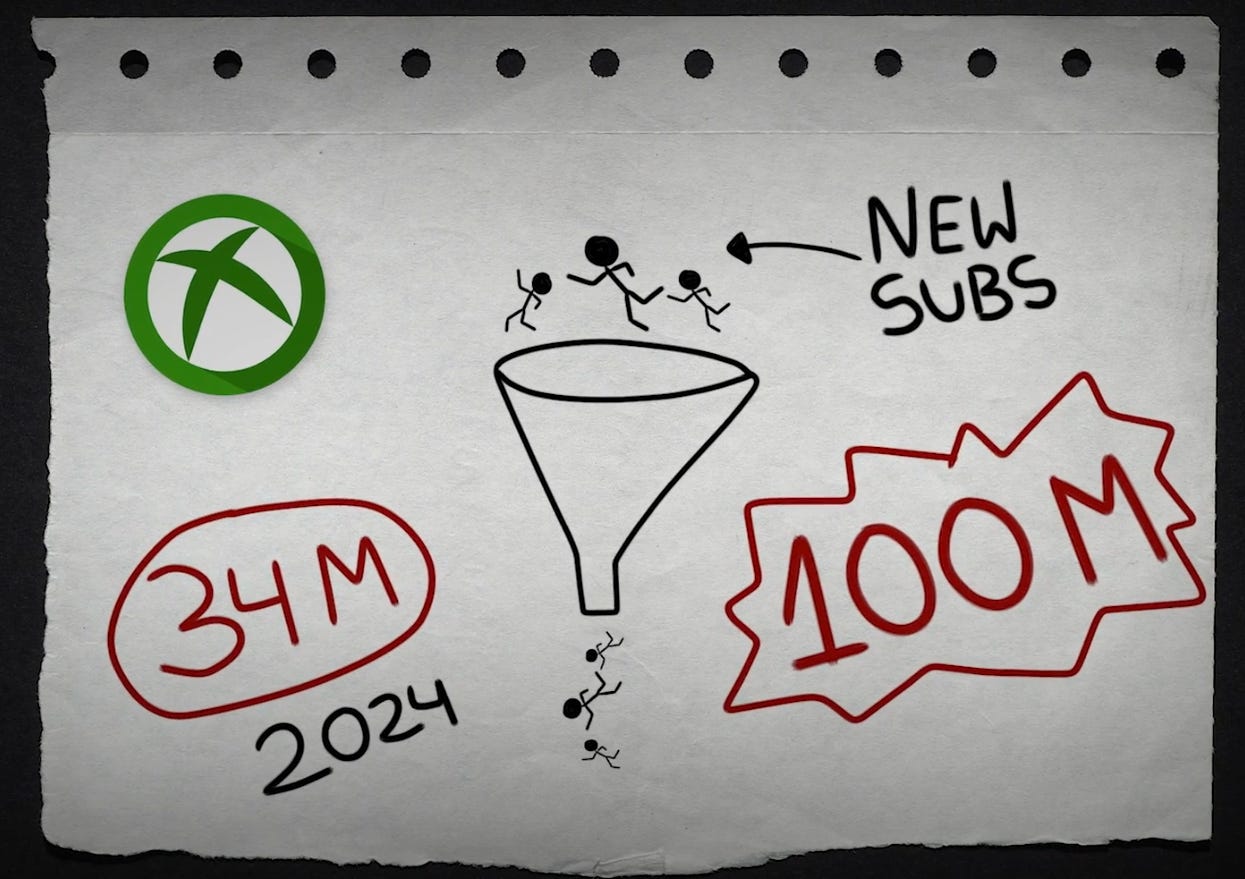

Now, Microsoft’s Xbox finds itself at a crossroads, much like Nintendo once did. Beaten in the console wars. Locked in an ecosystem battle with Sony. Xbox’s subscription service, Game Pass, was Microsoft’s big bet to pitch a Netflix of Gaming. Yet, it didn’t quite deliver. It hit 34 million subscribers this year—a climb, sure, but not what Microsoft aimed for, as it was missing its internal targets. And all that as they had shifted focus from console sales to subscription numbers.

Microsoft's struggle isn't just subscriptions. It's a tug-of-war for exclusive titles as well, with high-stakes gambles not always paying off. Competing against PS also seems a Herculean task, especially now that the PS5 is outselling Xbox 2:1. Their long awaited exclusive ‘Starfield’ was off to a good start with 13m players but didn’t break the Top 30 in Europe. Xbox mobile gaming remains locked behind 'walled gardens,' as Apple and Google keep their platforms tightly controlled and their cloud streaming potential is still just potential. And with each Xbox console sold at a loss, the traditional hardware sales model seems “under threat.” Now with the landscape not looking so rosy, one must ask: What is Microsoft's Project Revolution?

Well, their Project Revolution has been in the works for a while. While Nintendo’s revolution was doubling down on hardware, Xbox is thinking outside the box (woohooo).

Their revolution isn’t about the plastic under your TV. It’s about going back to a service-first, infrastructure-driven company. It’s about building a Universal Store that will sell games, content, and services across all devices. With Game Pass as the main vehicle and studio acquisitions of major franchises, it's clear Microsoft's betting big on their role as a publisher.

In their latest announcement, we hear that Xbox is starting to bring 4 of their exclusives to rival consoles. Xbox exclusives on Playstation and Switches. Putting games on rival platforms isn't just strategic—it's necessary, as they've long outlived their usefulness in selling consoles. So this isn’t about selling more consoles; this is about reaching every gamer in the world.

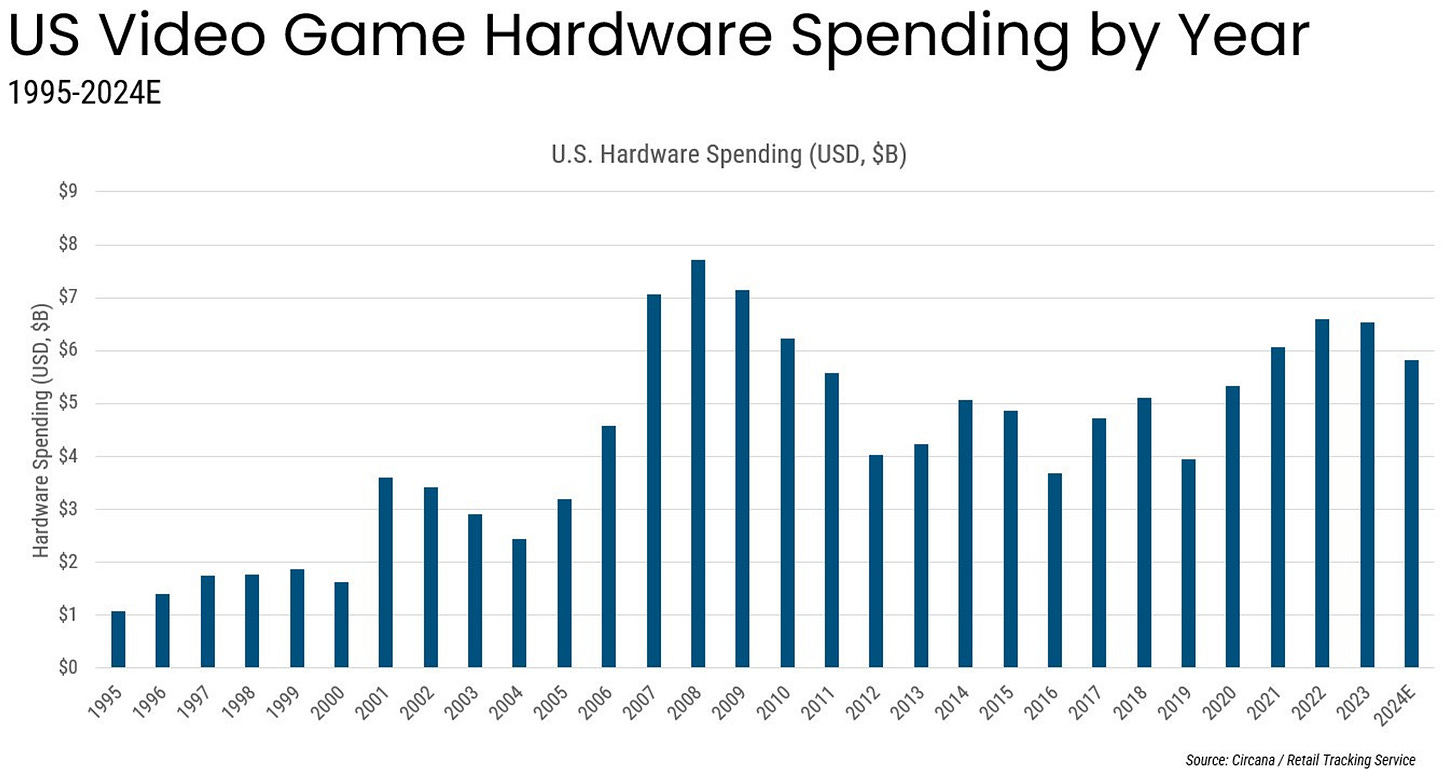

In fact, the US video game hardware market has hit a saturation point.

Xbox's key markets (U.S., U.K., Brazil, France, Germany and Mexico) are pretty much matured. As Microsoft’s gaming chief Phil Spencer said in an interview:

“I don't think we're doing a good enough job finding new players. We found 200 million global households that will play console games. And that number really hasn't changed in the last five, six years.”

This is a market ceiling issue more than anything.

The solution is Xbox morphing from a console to a gaming platform.

Microsoft’s focus is on business model diversity, not on monotony.

“Our business model is not just about hardware or first-party game sales. It’s a diverse business model that leads to the business success that we’re seeing today”

says Spencer in another interview.

And so Xbox Everywhere isn't just their strategy for survival – but a masterclass in adaptation. And with an eye on a $32 billion gaming revenue by 2030, their project is now boldly unfolding. And here is how:

CONSOLES & EXCLUSIVES

Making games is hard, and so is making hardware. It's a double challenge that Microsoft has faced head-on. A model also known as the “razor-razorblade” model. It’s a massive task that can be broken down into 7 steps.

R&D

Mass Manufacturing

Selling Subsidized Hardware

Recouping Costs through game sales and subscriptions

Marketing to keep pulling people in

Developing Exclusives to make the platform a must-have,

And creating a virtuous cycle that uses all these steps to make things cheaper over time.

The crux here is ‘recouping costs through game sales.’ In the early console days, when the gaming market was smaller, exclusivity wasn't just beneficial—it was essential. It allowed games to stand out and pushed platforms to innovate.

Sony, Sega and Nintendo made drastically different hardware which meant that exclusives not only attracted gamers but showcased what each console could do.

Sega lured players with Sonic, Nintendo with Mario and Zelda, and Sony, along with Microsoft, kept pace with their own iconic exclusives. A good example of how consoles defined the game experience is Bart vs the space mutants. The game had to be adpated to each consoles limitations. The Sega and computer verions each had their own control setups. Nintendo was able to show a slightly better UI than the Genesis, and the graphical quality differed from console to console. The same game, but a different feel on each system.

So exclusives weren’t just games. They were showcases. And still today they are part of a broader marketing strategy rather than direct profit sources. For instance, Halo 5 is an Xbox-only hit, Shadow of The Colossus stays on PlayStation, and esports favorites like Dota and League of Legends are PC-only. Exclusives not only kickstart sales but also drive consumer loyalty that span over generations of consoles:

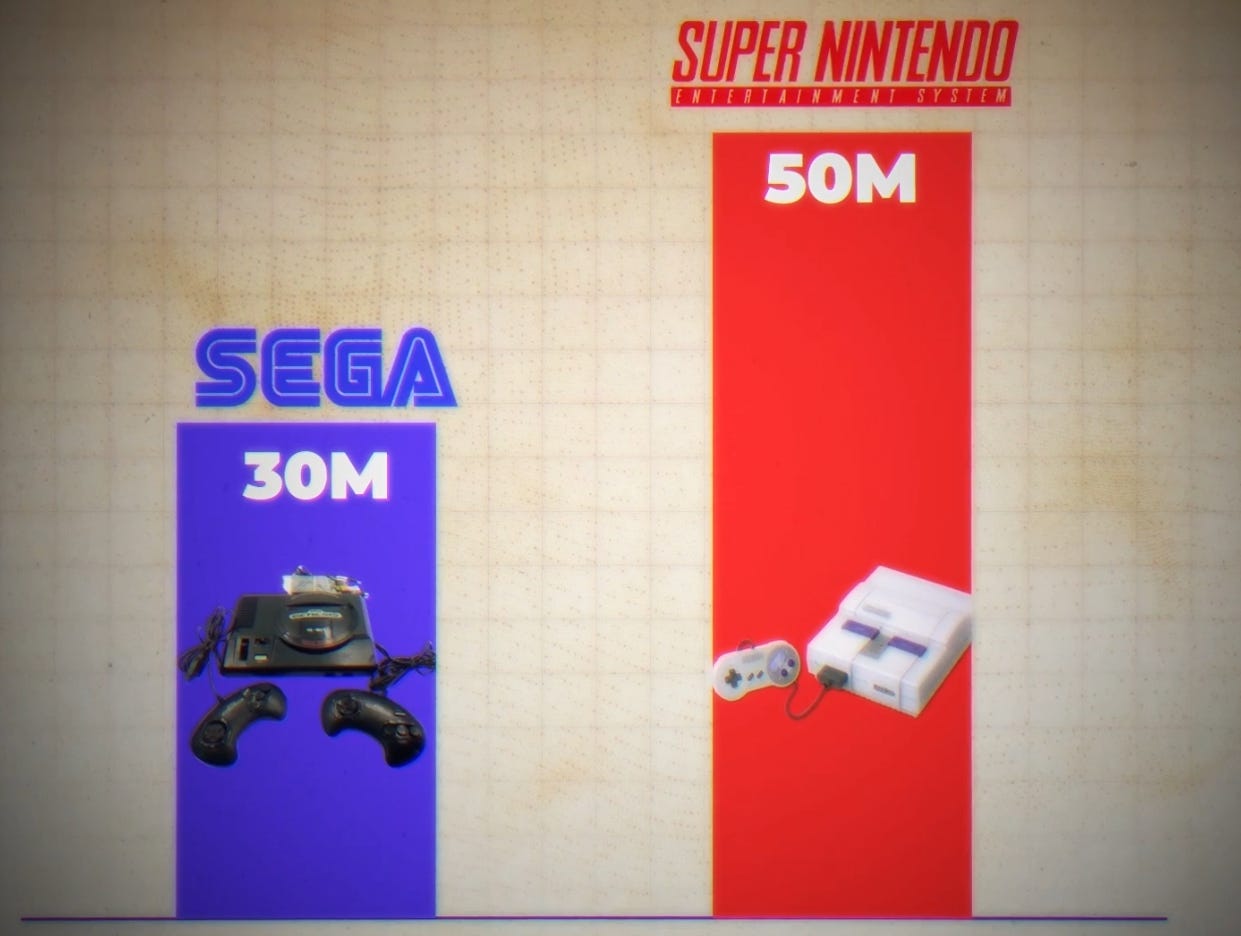

The 1st generation of consoles first revolved around basic games like Pong. The 2nd then introduced cartridges, with Atari leading before a “market crash.” The 3rd was then marked by NES, which revived the industry with our beloved Italian plumber and eventually sold 60M units using the computational power of 8-bit processors. By the 4th gen, the landscape had shifted, with Atari leaving and Sega entering the market with Sonic the Hedgehog. With a marketing slogan of “Sega does what Nintendon’t,” it sold over 30M Genesis units worldwide. Sega however did not win the war, as SNES sold over 50M units.

And then….

In the 5th gen, Sony enters the scene with game-changing exclusives, like FF 7. Previously developed for Nintendo, Sony secured this franchise for its PS, which used CDs rather than cartridges and supported the latest 3D graphics. By the 6th gen, the Playstation 2 continued to set records, thanks to exclusives like SOTC, FFX, GoW and many more.

And then…

“I see commentary, that if you just build great games, everything would turn around. It’s just not true, that if we go and build great games, that you see console sales shift in some dramatic way”

And then enters Microsoft. They entered the console wars not just to compete in gaming. The PS2 wasn’t just a console; it doubled as the cheapest DVD player on the market. To Microsoft, the PS was seen as a multimedia threat to their computer business. But the Xbox came with a killer app: Halo. Despite selling only 24M Xbox units to PS2's 158M, Halo launched as a gaming titan, now with over 80M copies sold globally. And Sega? Well, they couldn’t stand a chance and ceased to be a player in the market – the Dreamcast was its last console. By the 7th gen, the console wars heated up. The Xbox 360 closed in on the competition with a strong lineup of exclusives and strong sales, but the unexpected winner was the Wii. Remember? Project Revolution, playing a different game with motion controls and family fun. By the 8th gen, though, Sony swung back hard with PS4 thanks to an arsenal of hit exclusives while the Xbox One lacked the good games, required gamers to always stay online, and hit an identity crisis, as it was pushing the Kinect motion-tracking device, that no one wanted. In the end, Xbox One, with a few big games like Forza Horizon 2 and Halo 5, sold less than half as the Playstation 4 (51M vs 120M units).

…and then, Microsoft shifts strategy. Microsoft will not be using console shipments as its primary metric for success. Now, it's all about player engagement. Hence the Play Anywhere program in 2016, their first move to bridge Xbox and PC by letting you carry over saved games, addons and expansions. In a leaked email, Phil Spencer is again very determined on ‘engagement’. It’s clear: Xbox consoles have always sold at a loss, with losses up to $200 per unit. Recouping losses through exclusives, well, we know Xbox failed to continuously deliver on that front (looking at you, Redfall.)

The community demands a better release cadence and shouts “Just release better games”, but Phil thinks otherwise (Minute 37:06)

“I see commentary, that if you just build great games, everything would turn around. It’s just not true, that if we go and build great games, that you see console sales shift in some dramatic way.”

And then Phil made it very clear (Minute 36:17):

“We’re not in the business of out-consoling Sony or out-consoling Nintendo […] It’s just the truth of the matter is that if you’re third place in the console market place…”

There it is. Third place. If Microsoft is served the least by the traditional console business among the big three, then their February 2024 announcement hits the nail on the head.

A change in strategy which serves only one: the consumer. Who wouldn’t love their favorite games available on all platforms offering options especially for those who can’t buy every console? Well, turns out that the Xbox loyalists weren’t too thrilled by the news.

What’s their biggest concern? Putting exclusives on other platforms might lessen the special appeal of owning an Xbox. Ok. Duly noted. But…here is the thing with exclusives. Again. It made more sense back in the days. Today, platforms are less about hardware and more about the ecosystems, so the rationale for exclusives—which is driving hardware sales—becomes somewhat...archaic.

If you look at the PC market, there's choice and competition—each competing with deals, discounts and freebies. It's about value, not device-exclusive games. Console makers could learn a thing or two from the the PC market and stop hiding behind exclusives but focus on improving hardware features.

And for the record, a gamer who buys a console just for exclusives doesn't really invest in the ecosystem. True value comes from broader engagement.

But some console makers don’t get it and drive the ‘exclusivity game’ too far, so much so, it feels more like a monopoly.

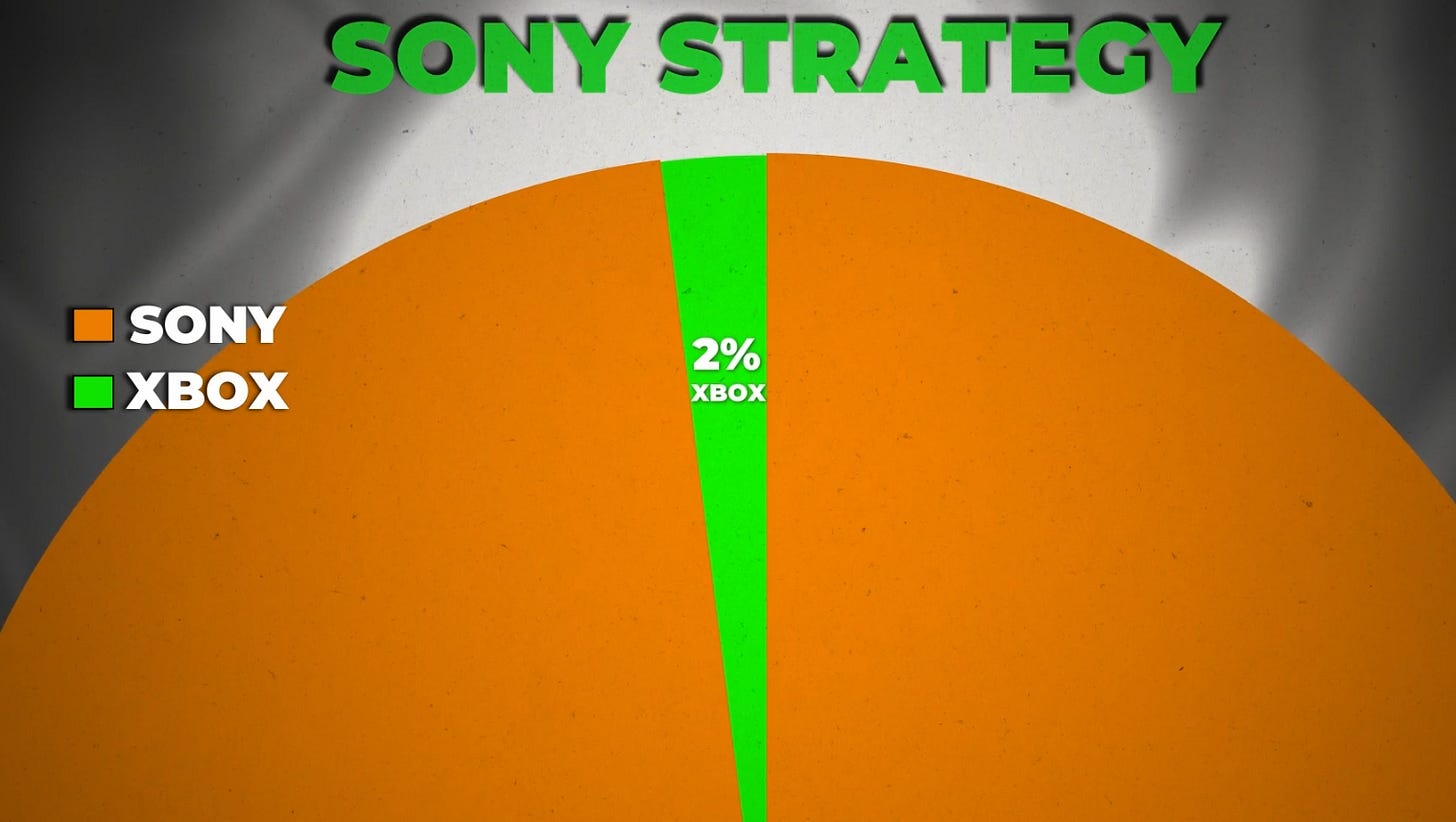

Sony's strategy, particularly in Japan, is a prime example. They've cornered about 98% of the high-end console market by locking down third-party titles exclusively for themselves, preventing Xbox from hosting these games in Japan. It went so far that 11 members of Congress were pressing the Biden administration to take action on the PlayStation-Xbox console competition in Japan due to “an imbalance in the Japanese video game market” and that “despite 20 years of investment, Xbox still has a negligible two percent share of the high-end console market.” #

This exclusivity frenzy impacts gamers directly. Remember the uproar over Playstation’s Call Of Duty: Black Ops Cold War? Extra loadout slots, tier skips – perks that gave PlayStation players an unfair edge. An unfair move that was criticised as “blatantly anti-consumer to PC and Xbox."

Exclusives have their place and time. But with Sony driving the game too far, for Microsoft, it was either a situation where it accepts a slow death, or they change the rules of the game entirely.

PUBLISHER

If it was up to Microsoft’s CEO Satya Nadella, he would “get rid of exclusives” as he “has no love for the battle over exclusives in the industry”. Putting software on more platforms, not fewer, is “the Microsoft he grew up in.”

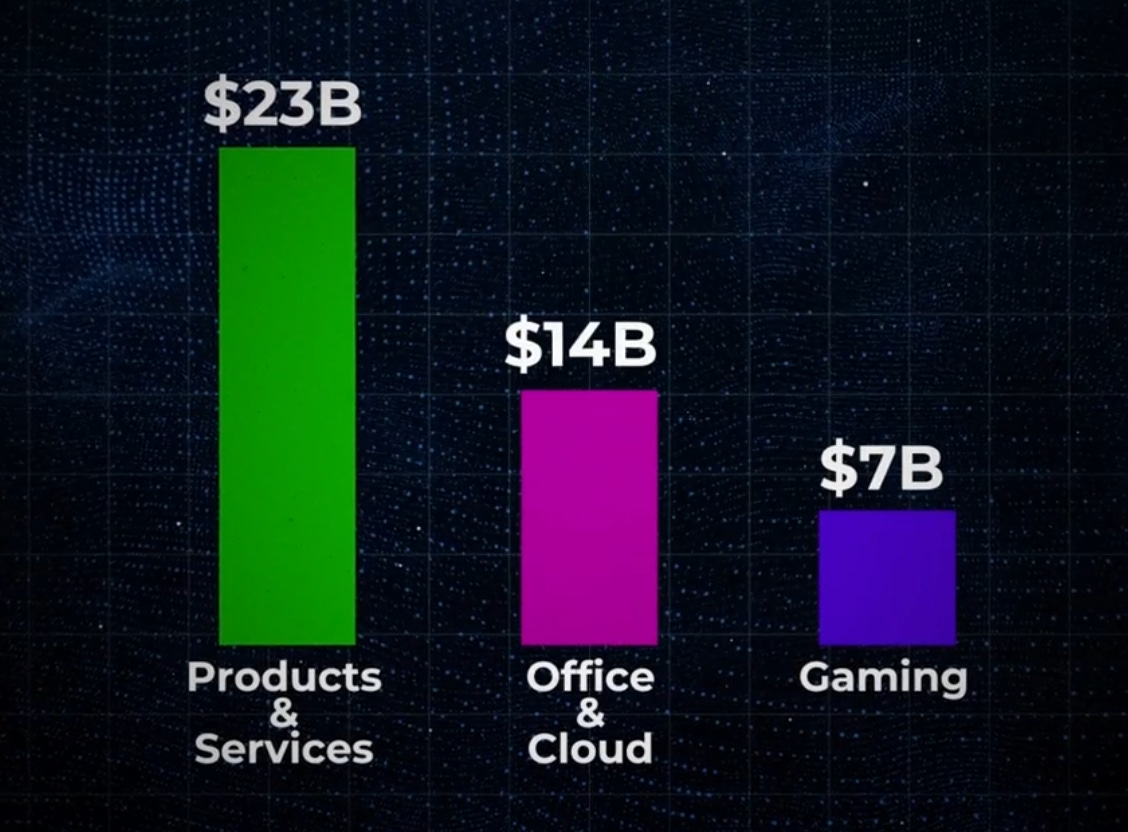

With this ethos in mind, Microsoft has been on a buying spree to become the dominant publisher: Mojang, Zenimax Bethesda and Activision Blizzard King (ABK) for a total of $75.4B. This isn’t about just buying up competition but about expanding their playground. Take Minecraft as a case in point. Even after acquiring it, Microsoft kept Minecraft cross-platform, making it now the most successful 3P game on Switch. And with ABK under its belt, Microsoft got franchises from CoD, WoW and Overwatch, to Candy Crush and Farm Heroes. Microsoft said the net impact from its Activision Blizzard deal was $2.08 billion in revenue and over 200m MAU across Xbox, PC and mobile. This deal made gaming Microsoft’s third-largest business category, next to Office and Services.

As we know, wrapping up this deal hasn’t been smooth sailing. The Federal Trade Commision raised eyebrows over monopoly concerns. Microsoft’s push for non-exclusivity might be – after all – about easing regulatory concerns and avoiding being seen as a monopoly. And Sony? Well, they weren’t fans of this deal at all, fearing it would upend the competitive balance. Really, Sony! Well, Japan’s competition regulators were ok with the deal and approved it.

One question stood out during the FTC hearings: “If the Xbox business isn’t meeting targets, why is Microsoft spending nearly $70 billion on Activision?”, to which Phil responded with “to expand in a meaningful way onto mobile, the world’s largest gaming platform.”

MOBILE & CLOUD

Already in 2022, Microsoft made headlines when it announced an “Xbox Mobile Gaming Store” with the “ABK deal being key to their mobile efforts.”

Why?

Because mobile gaming's huge—worth $200B now, and eyeing $700B by 2032.

By bringing big names like CoD mobile and Candy Crush to the table, their goal is to challenge Apple and Google’s tight grip on mobile gaming. Apple usually blocks other stores and payment methods on its devices. Yet, Europe's new Digital Markets Act is making them and Google open up. Apple's response? New rules, like a 50 cent charge per developer after a million downloads and still taking a 17% cut with other payment methods. MSFT called this move ‘a step in the wrong direction’ and is still hoping for the much needed change. One thing Apple has changed though: It opened up its App Store to allow game streaming apps, which were previously only accessible via a web browser. To Microsoft, that’s a step in the right direction as their cloud gaming ambitions are huge. Released in 2019, Xbox Cloud Gaming aims to bring games to markets like Africa, India, Brazil and Asia, all under the umbrella of “democratizing gaming globally” and reaching every gamer in the world. Xbox Cloud Gaming’s growth, as Phil notes, is booming mostly “in markets that are never going to be console markets.”

I talked about this in another video, where I interviewed the CEO of AntstreamArcade about the future of cloud gaming. All you need to know is that Microsoft owns Azure, their cloud infrastructure powerhouse, and has entered a 10-year partnership deal with Nvidia in 2023 to bring hit Xbox and PC games into the cloud. Leaked documents during the FTC trial also hint at a handheld device for hybrid-cloud gaming. Xbox president Sarah Bond mentioned in the latest podcast their “largest techincal leap ever.” Might this be the hand-held device? Or perhaps their ‘all-digital’ disc-less 2TB Xbox Series X? Time will tell. But one thing is for sure, hardware won’t go anywhere. This disc-less one sparked some speculation that Xbox is ready to move on from supporting disc-based games but MSFT said it will “follow what the customers are doing” and “deliver on the things that the customers want.”

And honestly, most of us buy games online. Consoles are the last tech with disc drives. Not many manufacturers are making these drives anymore, which means they’re getting more expensive. In any case, Spencer assures that “getting rid of physical, that's not a strategic thing for us.”

CONTENT & SERVICES

One very strategic thing though is their Content & Service category. Microsoft's core strength has always been services, software, and subscriptions, so it made sense when they introduced the Game Pass in 2017, a subscription service for a monthly fee and access to hundreds of games. Sounds great but the subscription business, just like game development, is really really hard. People sign up, but then opt out, or they churn because their credit card expired.

So everytime Xbox funnels in new gamepass subscribers, you have an equal amount fallinig out of the bottom. While it reported to have 34M subs in 2024, it’s miles away from hitting its goal of 100m game pass subs by 2030. That might be because Game Pass for Xbox Cloud Gaming on mobile hasn’t taken off yet. But as Phil said in an interview, their goals isn’t “to make everybody a game pass subscriber” anyways. The buzz about a native Xbox Cloud Gaming app for iOS could bring in fresh Game Pass subscribers though.

PLAYING THE LOOOONG GAME

Microsoft is changing gears but guess who is following suit? Sony. Sony’s pivoting towards multi-platform more and more. It wants half of its games to be available on PC by 2025 and Sony’s chairman Totoki said its first-party PC releases will be part of an “aggressive growth plan.” A no-brainer move looking at how Helldivers 2 did on PC.

And Nintendo? Well, they keep expanding their entertainment empire too with theme parks and movies all to push outside the traditional console business.

These moves are not on the same scale as what Xbox is doing, but the objective is the same. Finding new consumers and new money. But Microsoft is in a prime position. They’ve got something else up its sleeve: OpenAI. They don’t own it, but they own it. Microsoft invested $13B in OpenAI. Their new text-to-video AI model Sora creates lifelike, minute-long videos from simple text prompts. Like this one. Or this one. Or this one. Minecraft gameplay footage. Simulating digital worlds. I guess Sony and Nintendo will have to soon play catch-up. But the real competitiors aren’t Sony or Nintendo. As Phil says, these “traditional gaming companies are somewhat out of position.” The real face-off is with giants like Google, Amazon and Apple.

And so MSFT plays the long game to be the top dog in console, publishing, mobile, cloud, content, services and of course AI. This, was never about a console war, but content war. The Xbox? Just a stepping stone to a much bigger vision: An all-encompassing gaming universe.

It’s their very own kind of “Project Revolution”, that’ll keep Microsoft on top as a $3 Trillion titan.